Table of Content

To ask a question simply log in via your email or create an account. Not everyone wants or needs a loan with all the bells and whistles. So enjoy a simple straightforward approach instead with our HSBC Premier Floating Rate Home Loan.

What are the fees and charges for the premier loan. Some of the properties will be put up as collateral securities, it will be like two separate bundles, of 2 and 4 properties. We are looking 3 year fixed term for 5 loans and a mix of fix and variable for the house we live in. If you have a fixed-rate mortgage, you’ll continue to pay the same amount each month during your fixed-rate period. You can book a new fixed rate up to 180 days before this period ends. You'll have an annual overpayment allowance for fixed-rate mortgages equivalent to 10% of the outstanding balance of your mortgage.

Credit Cards

1International borrowers must have qualifying documentation to be eligible for an HSBC Preferred Mortgage, HSBC Deluxe Mortgage, HSBC Elite Mortgage or HSBC Summit Mortgage. Monthly mortgage payments must be made in U.S. funds. Questions and responses on finder.com are not provided, paid for or otherwise endorsed by any bank or brand.

The reset will be done by the 7th calendar day of the following month from RBI’s announcement of change in repo rate. A revision in the applicable rate of interest will lead to a revision in the Equated Monthly Instalment or the loan tenure at the Bank’s discretion. The applicable rate of interest rate on your loan is the RLLR plus the margin .

International Services

Find the home loan that's right for you, whether you're downsizing or buying a more expensive property. Protect yourself against rising interest rates and enjoy a range of competitive features with a HSBC Fixed Rate Home Loan Package. Rates are variable and linked to the HSBC Base Lending Rate and is subject to fluctuation at any anytime. Choose to repay either on a monthly or fortnightly basis. Available for purchase of fully-built property and refinancing of loans held with other institutions. Please read our website terms of use and privacy policy for more information about our services and our approach to privacy.

Marc Terrano is a lead publisher and growth marketer at Finder. He has previously worked at Finder as a publisher for frequent flyer points and home loans, and as a writer, podcast host and content marketer. Marc has a Bachelor of Communications from the University of Technology Sydney. He’s passionate about creating honest and simple reviews and comparisons to help everyone get value for money. A Fixed Rate Home Loan is where the interest rate is fixed for a term between six months and five years.

Managing your account

As a result you have the security and peace of mind of knowing exactly what you will have to repay over the period of time you have nominated. Interest rate is current as at 19 December 2022 and is subject to change. To be eligible for HSBC Home Loan Package, you must have minimum borrowings of $150,000 and pay the annual package fee of $390. The package fee will be deducted from the loan proceeds at settlement, and charged to the package home loan on the first business day of the loan anniversary month.

Available on refinance applications submitted to HSBC from 15 February 2021 to 28 February 2023 and settled by 30 April 2023. The option to lock in your home loan rate and protect you against rising interest rates2. What you need to know to find a home loan package with one of Singapore’s leading banks. Lynette is a writer for Singapore at Finder. An experienced personal finance writer and content creator, Lynette likes to break down complex concepts and empower her readers with simple takeaways.

Quick Apply

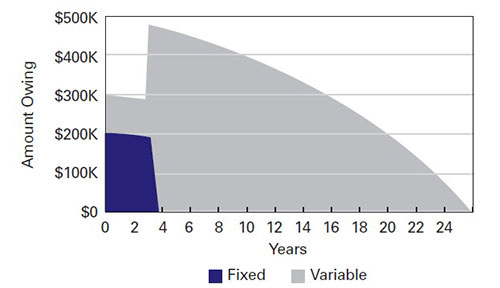

DollarBack Mortgage offers expert advice for property owners who require a loan. This loan offers interest rates with discounted rates built in as part of the package. If you'd like to also take advantage of a variable interest rate and some of the features offered by other HSBC home loans, a loan split option is available.

Although we provide information on the products offered by a wide range of issuers, we don't cover every available product or service. 5.Customers who maintain an HSBC Premier, HSBC One or Personal Integrated Account with a loan amount of HKD1,000,000 or above are eligible to apply for the Deposit-linked mortgage repayment plan. ~ Promotional offer available on new borrowings from $50,000. Variable interest rate is current as at 19 December 2022 and is subject to change.

You can usually get the same loan with a 25-year term. This means that your monthly repayments will be higher but you repay the loan faster (compared to a 30-year loan term). Providing or obtaining an estimated insurance quote through us does not guarantee you can get the insurance. Acceptance by insurance companies is based on things like occupation, health and lifestyle.

This is calculated annually on the date your fixed-rate period started. You can make additional payments during the fixed-rate period without incurring an early repayment charge . Anything over the 10% will incur an ERC, which is a charge you may have to pay if you repay the whole or part of your mortgage early. This includes if you move to a different HSBC mortgage rate, or move to a different lender during your fixed period. There's no early repayment charge for tracker mortgages. The above representative example is based on the highest APRC applicable to customers purchasing a property.

All decisions with respect to the loan shall be at the sole discretion of HSBC and the same shall be final, binding and non-contestable. Other than the specific entitlements available to the customers under this offer, any other claims with regard to this offer against HSBC are waived. Example – If non- utilization/Commitment fee fees is 1%, original sanctioned SCF amount is INR2,00,0000 and limit defined as 25% i.e. INR500,000 In this scenario if the fund in the SCF account is INR600,000, then the non-Utilization fees/Commitment fee of 1% will be charged on INR100,000. From 01 October 2019, all new mortgages (Home Loan & Loan Against Property) will be benchmarked to HSBC’s Repo Linked Lending Rate . HSBC’s RLLR is linked to RBI published Repo Rate.

No comments:

Post a Comment